How Risk Affects Currencies? What is Risk on Risk off?

Simply put, when the dollar is trading higher and equities are trading lower we have a Risk Off scenario.

And vice versa when the dollar is trading lower and equities are trading higher we have a Risk On scenario.

You can read our article about the detailed explanation of risk on risk off.

And how does risk affect currencies?

Remember, the dollar is the world reserve currency. And when the dollar moves everything moves. But not every currency moves in the same direction. Or does it?

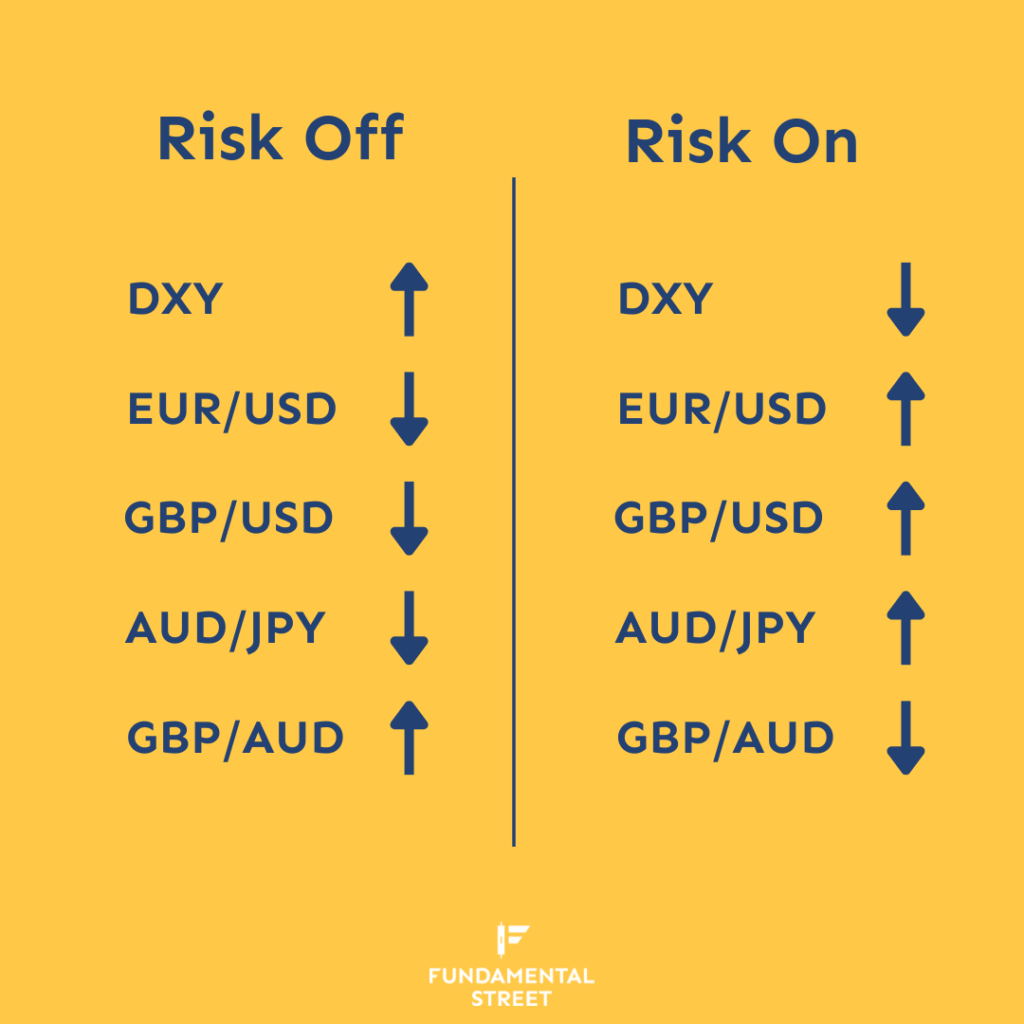

When we have a Risk Off scenario, and the dollar is trading higher we have inflows in dollars and outflows of the Euro, Pound, and Aussie dollars.

On the other hand in Risk on scenario, we have outflows of dollars and inflows into the Euro, Pound, and Aussie dollar.

But it’s not all that black and white. What happens when you want to trade GBP/AUD or EUR/AUD?

The Aussie dollar is very closely tied to commodities. So when we have the dollar higher, we have commodities trading lower, which negatively influences Aussie dollar. Below you can find a picture showing a visual representation of the Risk on Risk off idea and how respective pairs move accordingly:

If you still find it hard to grasp how Risk On Risk Off works, you can go on and read our detailed article on what it means.

We simplified the whole thought process in Macronomics and you can easily find where risk is in the markets and trade in line with risk. Check out Macronomics and stay on top of data.